(Apples Bite Magazine) -The Dangote Petroleum Refinery has slashed its ex-depot petrol price from ₦828 to ₦699 per litre, representing a significant reduction of ₦129 or 15.58 percent. This major price reduction marks the 20th adjustment in 2025 as local refining reshapes Nigeria’s fuel market.

The price adjustment, which took effect on Wednesday, December 11, 2025, marks approximately the 20th time the 650,000-barrel-per-day refinery has revised its Premium Motor Spirit (PMS) pricing this year, underscoring the dynamic nature of Nigeria’s evolving fuel market as local production capacity continues to expand.

The timing of the reduction is particularly strategic, coming just weeks before the Christmas and New Year holidays when fuel demand typically surges due to increased travel across the country. Market analysts view the move as a calculated effort by Africa’s richest man, Aliko Dangote, to capture greater market share from the Nigerian National Petroleum Company Limited (NNPC) and other major fuel marketers.

According to market data released on Friday by Petroleumprice.ng, the fresh downward adjustment positions Dangote Refinery as one of the most competitively priced fuel suppliers in the country, potentially forcing rivals to reconsider their pricing strategies or risk losing significant market share.

A source close to the refinery, who confirmed the development to Tribune Online, explained that the reduction demonstrates the company’s commitment to prioritizing the welfare of Nigerians and serves as appreciation for their continued support, especially during the festive season.

Context: A Year of Price Volatility

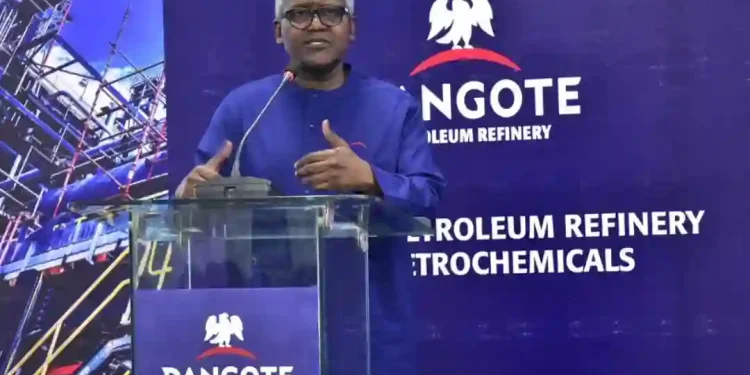

The latest price cut comes less than a week after Dangote Refinery’s Chairman, Aliko Dangote, reaffirmed his commitment to maintaining “reasonable and competitive” domestic fuel prices despite global market uncertainties and persistent fuel smuggling across Nigeria’s porous borders.

Speaking to journalists after a closed-door meeting with President Bola Ahmed Tinubu on December 6, 2025, Dangote indicated that prices would continue to decline as the refinery ramps up production capacity and enhances its competitive position against imported petroleum products.

“Prices are going down. The reason why prices have to go down is that we have to also compete with imports,” Dangote stated. “But luckily for us now, the smuggling has reduced, not totally. There is still quite a lot of smuggling because the price we have in Nigeria is about 55 percent lower than the price of our neighbouring countries.”

The billionaire industrialist emphasized that petroleum products, including diesel and petrol, “will continue to be sold in the market at a very reasonable price,” adding that the refinery’s pricing strategy is focused on long-term sustainability rather than quick returns on the massive $20 billion investment.

“We are not here to make our $20 billion back quickly; it’s a long-term investment,” Dangote declared, signaling his willingness to operate on thinner margins to establish market dominance and contribute to Nigeria’s energy security.

Market Implications and Consumer Impact

Industry experts believe the ex-depot price reduction could trigger a ripple effect across the retail fuel market, potentially pushing pump prices down from the current range of ₦915 to ₦937 per litre observed at many filling stations in Abuja and other major cities.

If independent marketers and fuel retailers pass on the savings to consumers, Nigerians could see petrol selling for between ₦750 and ₦850 per litre at the pump, depending on distribution costs, retailer margins, and location-specific factors.

Such a reduction would provide significant economic relief to millions of Nigerians who have grappled with high transportation costs and inflation in recent months. Lower fuel prices typically translate to reduced costs for public transportation, logistics, and goods distribution, potentially easing pressure on household budgets during the expensive holiday season.

“This is welcome news for ordinary Nigerians,” said Dr. Muda Yusuf, Director of the Centre for the Promotion of Private Enterprise (CPPE). “Fuel is a critical input cost in virtually every sector of the economy. When petrol prices fall, we typically see positive effects cascading through transportation, food prices, and general cost of living.”

Competitive Pressure on NNPC and Independent Marketers

The Dangote Refinery’s aggressive pricing strategy places considerable pressure on NNPC Limited and independent petroleum marketers, many of whom have already announced at least two price reductions in the past three weeks in response to earlier cuts by Dangote.

Marketers who purchased and stocked fuel at higher prices now face potential losses or significantly reduced profit margins. Some industry observers suggest that smaller, independent retailers with limited working capital may struggle to compete, potentially leading to market consolidation in the medium term.

“Dangote’s pricing power is formidable,” noted Mr. Chinedu Okoronkwo, National President of the Independent Petroleum Marketers Association of Nigeria (IPMAN). “While we welcome competition and lower prices for consumers, marketers need adequate margins to sustain operations. We are monitoring the situation closely and will engage with all stakeholders to ensure a level playing field.”

NNPC Limited, which previously dominated Nigeria’s downstream petroleum sector, has yet to officially respond to Dangote’s latest price reduction. However, sources within the state oil company suggest that internal discussions are ongoing regarding potential pricing adjustments and supply strategy modifications.

The Broader Transformation of Nigeria’s Oil Industry

Dangote Refinery’s frequent price adjustments throughout 2025 reflect a fundamental transformation in Nigeria’s downstream petroleum sector. For decades, Africa’s largest oil producer paradoxically relied heavily on imported refined products due to the underperformance of its state-owned refineries.

The commissioning and gradual scaling up of the Dangote Refinery in Lekki, Lagos—reportedly the world’s largest single-train refinery—has begun to reverse this dynamic. As local refining capacity expands, Nigeria is experiencing greater supply stability, reduced fuel queues, and more competitive pricing based on actual production costs rather than import parity pricing.

Energy economist Dr. Dolapo Oni noted that the shift toward local refining has already yielded tangible benefits. “We’ve seen a dramatic reduction in fuel scarcity, shorter queues at filling stations, and more transparent pricing mechanisms. The Dangote Refinery is forcing the entire sector to become more efficient and consumer-focused.”

However, challenges remain. The smuggling of Nigerian petroleum products to neighboring countries—where prices are significantly higher—continues to drain domestic supply and represents lost revenue. Dangote acknowledged that smuggling has decreased but remains a concern, particularly along Nigeria’s extensive land borders with Benin Republic, Niger, Chad, and Cameroon.

Security agencies and regulatory bodies, including the Nigeria Customs Service and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), have intensified efforts to curb cross-border fuel smuggling through increased patrols and stricter enforcement.

Regional and International Context

Nigeria’s petroleum pricing dynamics exist within a broader West African context. Fuel prices in neighboring countries such as Benin Republic, Togo, and Ghana remain substantially higher than Nigerian prices, creating strong economic incentives for smuggling.

The Dangote Refinery’s competitive pricing strategy also has implications for regional fuel markets. As Nigeria becomes a net exporter of refined petroleum products, it could emerge as a key supplier to other West African nations, potentially reshaping regional energy trade patterns.

International oil companies and trading firms that previously supplied imported fuel to Nigeria are reassessing their strategies in light of growing local refining capacity. Some have begun exploring partnerships with Nigerian distributors or pivoting toward other markets in the region.

Government’s Role in a Deregulated Market

The Nigerian government’s petroleum subsidy removal in 2023 paved the way for the current market-driven pricing environment. While the subsidy’s elimination initially caused prices to spike, the subsequent entry of Dangote Refinery and the deregulation of the downstream sector have introduced genuine price competition.

President Tinubu’s administration has repeatedly emphasized its commitment to allowing market forces to determine fuel prices while ensuring adequate regulatory oversight to prevent exploitation and maintain quality standards.

During his recent meeting with Dangote, President Tinubu reportedly expressed satisfaction with the refinery’s contribution to national energy security and encouraged further investment in the petroleum sector. The Presidency has not issued an official statement on the latest price reduction, but government officials have previously welcomed Dangote’s pricing decisions as evidence that deregulation is working.

Looking Ahead: Sustainability and Market Evolution

As Nigerians prepare for the festive season with the prospect of more affordable fuel, questions remain about the sustainability of current pricing levels and the long-term evolution of the market.

Oil market analysts point out that global crude oil prices, foreign exchange rates, and operational costs will continue to influence domestic fuel pricing. Dangote Refinery’s ability to maintain competitive prices depends partly on its sourcing strategy, operational efficiency, and access to crude oil at favorable terms.

The refinery has secured agreements to purchase crude oil from Nigerian producers, including some priced in naira rather than dollars—a development that could insulate domestic prices from foreign exchange volatility to some extent.

Industry watchers also anticipate that as Port Harcourt, Warri, and Kaduna refineries potentially come back online following rehabilitation efforts, additional local refining capacity could further intensify competition and stabilize prices.

Consumer Reactions and Economic Outlook

On social media and in markets across the country, news of the price reduction has been met with cautious optimism. Many Nigerians have expressed hope that fuel retailers will quickly pass on the savings, though some remain skeptical based on past experiences where ex-depot price cuts did not always translate to equivalent reductions at the pump.

Economic analysts suggest that sustained lower fuel prices could contribute to moderating inflation, which has remained stubbornly high throughout 2025. Transport costs are a significant component of Nigeria’s consumer price index, and reductions in fuel prices typically have multiplier effects across the economy.

“If this price reduction holds and is passed on to consumers, we could see positive impacts on inflation figures in the coming months,” noted Mrs. Patience Oniha, former Director-General of the Debt Management Office. “This would provide some relief to households and businesses that have been under considerable economic pressure.”

However, she cautioned that fuel pricing is just one element of Nigeria’s complex economic challenges, which include foreign exchange volatility, security concerns, and infrastructure deficits that continue to constrain growth.

Conclusion

The Dangote Refinery’s decision to reduce petrol prices to ₦699 per litre represents more than a seasonal gesture—it signals a new era in Nigeria’s petroleum sector characterized by local production, genuine competition, and market-driven pricing.

As the country navigates this transition, the ultimate beneficiaries should be Nigerian consumers and businesses that depend on affordable, reliable energy. Whether this pricing level proves sustainable and how competitors respond will shape the downstream petroleum landscape well into 2026 and beyond.

For now, Nigerians heading into the festive season can anticipate some relief at the fuel pump, courtesy of Africa’s largest refinery and its billionaire owner’s stated commitment to long-term value creation over short-term profits.

This story is developing. Further updates will be provided as NNPC, independent marketers, and regulatory authorities respond to Dangote Refinery’s latest pricing decision.

Related Topics: Dangote Refinery | Petroleum Prices | NNPC | Nigerian Economy | Fuel Market | Aliko Dangote | Energy Security

Contact: For more information on fuel pricing and market developments, visit Petroleumprice.ng or contact the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

Seunmanuel Faleye is a brand and communications strategist. He is a covert writer and an overt creative head. He publishes Apple’s Bite International Magazine.