A groundbreaking fuel supply agreement between Dangote Petroleum Refinery and 20 major petroleum marketers has fallen apart after just one month, triggering a massive surge in petrol imports that reached 1.563 billion litres in November 2025, investigations have revealed.

The collapsed arrangement, which was designed to streamline Nigeria’s fuel distribution and stabilize prices, unraveled over disagreements about pricing adjustments as international oil benchmarks declined, leaving the refinery and marketers at odds.

The deal, finalized in October 2025, was structured as a pilot program requiring 20 selected depot owners to collectively purchase approximately 600 million litres of petrol monthly from Dangote Refinery, with each marketer lifting roughly 30 million litres. The arrangement was aimed at reducing middlemen in the supply chain and bringing down pump prices for Nigerian consumers.

Chinedu Ukadike, National Public Relations Officer of the Independent Petroleum Marketers Association of Nigeria (IPMAN), had initially confirmed that the agreement followed strategic discussions with major downstream players including A.Y.M. Shafa, A.A Rano, NNPCL Retail, and Salbas.

“Dangote announced plans to sell to only 20 selected marketers who will serve as primary distributors to other dealers. Each of them will lift a minimum of two million litres, translating to about 600 million litres every month,” Ukadike explained at the time, expressing optimism that the structure would improve availability and ease retail prices.

However, industry sources speaking on condition of anonymity told The PUNCH that the agreement contained a monthly price review clause that became the source of conflict. Initially, products were sold at N806 per litre for coastal delivery and N828 per litre at the gantry, while Dangote suspended direct sales to smaller independent marketers who typically purchased 250,000 litres or less.

The arrangement worked smoothly through October, but tensions erupted in November when international petrol prices dropped significantly below Dangote’s selling price. Marketers noted that based on global benchmarks, prices should have fallen to around N750 per litre, but the refinery was slow to adjust.

“The agreement had issues in November when importers saw that international benchmark prices were lower than what Dangote was selling to them,” one source explained. “Dangote was reluctant to review. This caused the heavy influx of imported petrol in November.”

Data from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) confirmed the import surge, with November 2025 recording 1.563 billion litres in total imports.

Dangote eventually slashed its gantry price to N699 per litre, the lowest rate in 2025, but the reduction came too late. Depot owners and marketers who had purchased products at N828 per litre in October and hadn’t yet sold faced substantial losses.

According to Major Energies Marketers Association of Nigeria (MEMAN) data, the average landing cost of imported premium motor spirit dropped to N829.77 per litre by late October, making it cheaper than Dangote’s locally produced fuel, which remained at N877 per litre on October 24, 2025.

Jeremiah Olatide, CEO of petroleumprice.ng, confirmed the collapse, explaining that the pricing mechanism was tied to Eurobob, the international benchmark for European gasoline, with monthly reviews expected to track global crude oil movements.

“After the first month, the international crude oil benchmark dropped, and private depot owners requested a reduction in the Dangote gantry price. The reduction was effected but not what they expected compared to international prices. This difference made marketers turn to imports in November 2025,” Olatide said.

The dispute reportedly escalated into a public confrontation between Dangote and former NMDPRA boss Farouk Ahmed over the agency’s issuance of import licenses to other marketers, a conflict that culminated in Ahmed’s resignation in December 2025.

Confirming the deal’s termination, IPMAN’s Ukadike told The PUNCH that Dangote has now liberalized its sales approach. “It is no longer in place. Dangote has decided to liberalize the buying options. Marketers are now free to buy products, even down to those who can lift as little as 250,000 litres,” he said.

Ukadike added that some marketers violated the agreement by continuing to import petrol even after signing the October exclusivity deal, which contributed to the breakdown.

The refinery has now reverted to open-market sales, accepting orders from any marketer regardless of volume, a significant departure from the October arrangement.

Dangote spokesperson Anthony Chiejina did not respond to requests for comment.

Meanwhile, current market data shows imported petrol spot prices have dropped to approximately N696 per litre at Apapa jetty, slightly below Dangote’s current gantry price of N699 per litre, according to MEMAN’s latest energy bulletin.

The pricing shift has been driven by declining international crude benchmarks, with Brent crude trading at $63.75 per barrel, WTI at $60.14, and Bonny Light around $66.22 per barrel. Additionally, the naira has strengthened to N1,419.07 against the dollar, down from N1,450 in early December.

The 30-day average import parity price stands at N772.65 per litre, creating a N76 per litre gap with spot prices that marketers can exploit for inventory optimization as local refiners adjust their pricing strategies.

READ ALSO:

- Kano to Get ₦1 Trillion Metro Rail System as FG Approves Major Transport Project

- Angola Oil & Gas Launches in Luanda as $70B Investment Momentum Accelerates

- Nigeria Launches Locally-Made Armoured Combat Vehicle, Pledges Continued Support for Domestic Defence Manufacturing

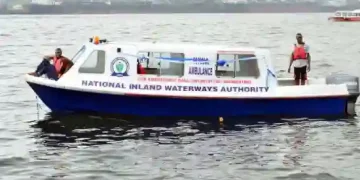

- NIWA Intensifies Campaign to Eliminate Boat Accidents Across Nigeria

- Activists Soweto and Frank Get N200,000 Bail Over Lagos Anti-Demolition Protest