The sound of barking dogs now echoes through Nairobi’s Karura Forest as an unprecedented pet ownership surge transforms one of Africa’s most cherished green spaces into an impromptu dog park. What was once a quiet morning sanctuary has become a bustling showcase of canine diversity, reflecting a broader continental trend that’s reshaping how Africans view pet ownership.

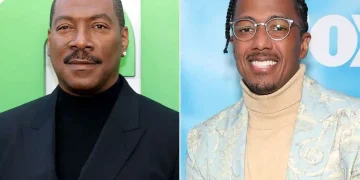

Servita Verma, who regularly walks her Terrier named Chali through the forest trails, has witnessed this transformation firsthand. Where she once encountered only a handful of fellow dog owners during weekday morning strolls, the paths now resonate with constant barking as Huskies, Chow Chows, and Shih Tzus explore the undergrowth alongside their owners.

Weekend visits to the park—famously protected from developers by late Nobel Peace laureate Professor Wangari Maathai—have evolved into elaborate parades of dog breeds. Shaggy Komondors mingle with fluffy Pomeranians, while Dobermans and stern-faced Rottweilers accompany joggers and families on their outdoor adventures.

This scene captures a remarkable shift occurring across Africa, where pet ownership is rapidly expanding as disposable incomes rise and cultural attitudes toward companion animals evolve. The continent’s burgeoning middle class is increasingly viewing pets as essential family members rather than mere security assets, driving unprecedented growth in the pet care industry.

Economic Growth Fuels Pet Market Expansion

Africa’s improving economic prospects provide the foundation for this pet ownership boom. The African Development Bank projects that 21 countries will achieve economic growth exceeding 5% in 2025, while the continent’s overall economy is expected to accelerate from 3.3% in 2024 to 3.9% in 2025, reaching 4% by 2026.

This economic momentum is expanding Africa’s middle class substantially. Currently, 21 countries hold lower-middle-income status, while eight nations—including South Africa, Botswana, and Namibia—have achieved upper-middle-income classification according to World Bank data. As household earnings grow, consumers are increasingly willing to invest in pet care products and services.

The financial commitment is significant. In Kenya, pet owners routinely spend between 2,200 and 3,000 Kenyan shillings (US$19-26) for a 5-kilogram bag of organic pet food, demonstrating their willingness to prioritize premium nutrition for their animals.

The numbers tell a compelling story of market expansion. Mordor Intelligence projects Africa’s pet food market will grow at a compound annual growth rate of 12.28% over the next four years—substantially outpacing the global average of 8.54%. This growth trajectory positions Africa as one of the world’s fastest-expanding pet markets.

South Africa leads the continental market with impressive statistics: over 7.4 million dogs and 2 million domestic cats call the country home. The nation’s pet food market generated $596.17 million in revenue as of March 2025, with some estimates placing the figure as high as $800 million. The market maintains a robust annual growth rate of 12.20% through 2030.

Per capita spending on pet food in South Africa reached US$9.21 in 2025, reflecting consumers’ increasing prioritization of pet nutrition. This spending pattern has attracted international attention, with Amazon expanding its South African operations to include pet food and related supplies, recognizing the market’s substantial potential.

Major African cities serve as epicenters for this pet ownership revolution. Lagos, Johannesburg, Cairo, and Accra are witnessing middle-class families increasingly embrace pets as integral family members. The shift is particularly visible in changing attitudes toward animal acquisition, with more rescue centers and animal therapy facilities opening across major urban areas.

This trend reflects a fundamental cultural evolution—pets are increasingly viewed as companions rather than security assets, leading to higher adoption rates from rescue organizations rather than purchases from breeders.

Nairobi exemplifies this urban transformation with its surge in high-end pet shops, mobile dog grooming services, and veterinary clinics offering specialized services like tooth scaling and medicated flea treatments. At Petzone in Westlands, a popular Nairobi suburb, 2-kilogram bags of grain-free salmon kibble share shelf space with imported cat pâtés and probiotic chew sticks.

While South Africa dominates the continental market, other nations are rapidly catching up. Kenya and Nigeria trail in spending but show accelerating growth patterns. Johannesburg and Cape Town already offer diversified product ranges including veterinary diets, cat-specific foods, and senior pet formulas.

Egypt’s pet care market maintains steady growth despite economic challenges, with dry dog food remaining the dominant category. Local brands are gaining market share due to import restrictions, while retail e-commerce emerges as the fastest-growing sales channel.

Nigeria presents a complex market dynamic. Despite economic pressures, nearly half of urban Nigerian households now report pet ownership according to recent consumer data. However, inflation reaching 34.80% in December before moderating to 23.71% in April has significantly impacted purchasing power.

The economic strain is evident in pet food pricing: a 15-kilogram bag of dog food increased from 40,000 Naira (US$25.70) to 70,000 Naira—matching the country’s minimum monthly wage. Consequently, pet food imports are expected to decline from 1.3 million kilograms in 2023 to 769,000 kilograms by 2028, while local producers experience increased demand.

Local Entrepreneurs Seize Opportunities

African entrepreneurs are rapidly responding to this market opportunity. Companies like South Africa’s Afrique Pet Food, established in 2003, are ramping up production to meet growing demand. Local production offers advantages beyond cost savings—it leverages Africa’s abundant agricultural and livestock resources.

Africa for Investors (AFI), a platform connecting global investors with continental opportunities, identifies pet food as one of the most lucrative yet underexploited business ventures. The organization notes that locally sourced ingredients including maize, sorghum, and high-quality meats create unique opportunities for producing nutritious pet food while serving an expanding market.

Global Context and Future Outlook

Africa’s pet ownership surge aligns with global trends, particularly among millennial and Generation Z households. For comparison, Buenos Aires, Argentina, recognized as the world’s pet capital, boasts pet ownership in nearly 80% of households—20% higher than average US cities according to Associated Press data.

However, Africa’s growth trajectory appears more dynamic. While the United States leads globally with $62 billion in pet market revenue for 2025, Africa’s double-digit growth rates suggest the continent will capture an increasingly significant share of the global pet economy.

The trend toward pet humanization continues driving demand for premium products across the continent, supported by the emergence of e-commerce as a primary sales channel. As economic growth continues and middle-class expansion accelerates, Africa’s pet market is positioned for sustained growth, transforming not just forest trails in Nairobi but the entire landscape of human-animal relationships across the continent.

By Seth Onyango, bird story agency

Bird Story Agency is a specialist news agency driven by the resolve to project Africa by telling positive stories about the continent.