Heirs Energies, a Nigerian oil producer, has obtained a $750 million credit facility from the African Export-Import Bank to finance its production operations, the company announced.

The Lagos-based energy firm finalized the financing agreement with the Cairo-based multilateral lender on December 20. According to the company’s statement, the facility will “strengthen Heirs Energies’ balance sheet, enhance liquidity, and provide the flexibility required to accelerate field development and optimize production.”

The company currently manages Oil Mining Lease 17, an asset it acquired from Shell Plc in 2021. In August, Heirs Energies revealed ambitious growth targets, aiming to double its daily output from 55,000 barrels to 110,000 barrels by 2030, while simultaneously extending its footprint across the African continent.

The expansion comes amid a broader transformation in Nigeria’s oil sector, where domestic independent producers are capitalizing on improved operational conditions. These companies have been acquiring onshore and shallow-water assets from international oil majors that are redirecting their focus toward deepwater exploration.

Other Nigerian independents, including Seplat Energy Plc, Oando Plc, and Renaissance Africa Energy Co., are similarly ramping up activities by reactivating dormant wells and channeling substantial investments into new drilling projects and infrastructure upgrades. These efforts are part of a collective push to help Nigeria increase its overall crude oil production capacity.

READ ALSO:

- Kano to Get ₦1 Trillion Metro Rail System as FG Approves Major Transport Project

- Angola Oil & Gas Launches in Luanda as $70B Investment Momentum Accelerates

- Nigeria Launches Locally-Made Armoured Combat Vehicle, Pledges Continued Support for Domestic Defence Manufacturing

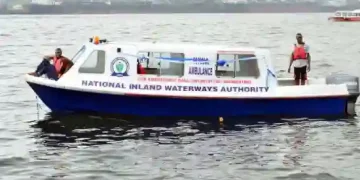

- NIWA Intensifies Campaign to Eliminate Boat Accidents Across Nigeria

- Activists Soweto and Frank Get N200,000 Bail Over Lagos Anti-Demolition Protest