Nigerian Crypto Exchange Launches Redesigned Platform, Local Currency Savings, and Asset-Backed Loans to Bridge Traditional and Digital Finance

Busha, a licensed cryptocurrency exchange in Nigeria, is stepping beyond its crypto roots with a comprehensive brand transformation that repositions the platform as a full-service digital money application. The company has introduced a new logo, completely redesigned mobile interface, and launched innovative financial products that merge cryptocurrency trading with conventional money management.

The transformation addresses growing demand from users in emerging markets who need flexible, secure solutions to manage both traditional currency and digital assets from a single regulated platform—whether they’re building savings in local currency, trading diverse asset classes, or accessing cash without liquidating their investments.

Busha’s refreshed logo incorporates imagery of both a currency note and coin, visually representing the company’s mission to seamlessly blend fiat and cryptocurrency in everyday financial activities. The redesign signals the platform’s maturation from a specialized crypto exchange into a comprehensive financial hub where users can handle all their monetary needs with equal ease.

The company has completely rebuilt its app experience with an emphasis on intuitive navigation and user clarity. The new interface caters to both cryptocurrency newcomers and seasoned traders, simplifying fund management and enabling more informed financial decision-making across all experience levels.

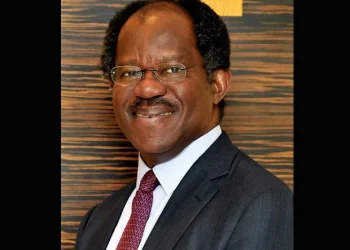

“We started Busha as a trusted, regulated gateway to crypto in Nigeria. Over time, it became clear that crypto was not the end goal; it was the foundation,” said Michael Adeyeri, co-founder and Chief Executive Officer at Busha. “What we are building now is broader and more ambitious—a single money app where Africans can live their entire financial lives. This brand refresh represents more than a new look for Busha; it marks a new chapter in how we serve our users.”

The platform’s expanded product lineup now includes local currency savings accounts that offer competitive interest rates through secure, flexible savings options. Additionally, Busha has introduced asset-backed lending, beginning with cryptocurrency-collateralized loans that provide users with immediate liquidity while allowing them to maintain their investment positions and potential for long-term growth.

“This launch is just the beginning. We are rolling out these features in phases, starting with Nigeria, while preparing to expand into additional emerging markets,” said Moyo Sodipo, co-founder and Chief Operating Officer at Busha. “Our focus is on building thoughtfully, listening to our users, and delivering products that truly meet their financial needs.”

The timing of Busha’s expansion aligns with accelerating adoption of digital financial services and stablecoins throughout emerging markets, fueled by improving financial literacy, clearer regulatory frameworks, and increasing appetite for alternative financial solutions. By integrating cryptocurrency capabilities with traditional banking features, Busha is establishing itself as a comprehensive financial partner for the next generation of users in developing economies.

With over one million users across Nigeria and Kenya, Busha plans to extend its services into additional emerging markets while continuing to add new features in the coming months. The enhanced Busha app is currently available for download and update on both iOS and Android platforms in Nigeria.

About Busha

Busha is one of Africa’s premier digital asset exchanges, operating as a Securities and Exchange Commission (SEC)-authorized Virtual Asset Service Provider in Nigeria. Established in 2019, the platform has grown to serve more than one million users and businesses across Nigeria and Kenya, delivering a secure and user-friendly environment for purchasing, selling, and managing digital assets. Recognized for its regulatory compliance, robust liquidity, and superior user experience, Busha is leading the charge in advancing responsible innovation throughout Africa’s digital financial landscape.

READ ALSO:

- US Survivors of Online Sexual Abuse Face Systemic Failures and Legal Void, Report Reveals

- Ex-Nigeria Oil Minister Diezani Alison-Madueke on Bribery Trial Spent £2m at Harrods, Court Hears

- Turkish Officials Call Nigerian Media’s Focus on Tinubu’s Stumble ‘Silly and Mischievous’ – Dabiri-Erewa

- Lawmakers Condemn Gombe Bandit Attacks, Press for Swift Military Response

- NSCDC Clarifies Position on Delayed Promotion Arrears Payment