Nigerian fintech Paystack has reorganized into The Stack Group, a new holding company structure, following achievement of group-wide profitability and consistent monthly cash flow.

The restructuring consolidates Paystack’s payments platform, consumer app Zap, Paystack Microfinance Bank, and venture studio TSG Labs under a single corporate umbrella. The move signals Paystack’s evolution beyond its original merchant payments focus into broader financial services.

Since Stripe’s $200 million acquisition of Paystack in 2020, the Nigerian company operated as a wholly owned subsidiary. The Stack Group introduces a different ownership model, with stakes held by CEO Shola Akinlade, Stripe, and Paystack employees (called Stacks). Specific ownership percentages remain undisclosed.

“People building the business should share in its growth, while we continue to benefit from Stripe’s long-term partnership,” said Amandine Lobelle, The Stack Group’s chief operating officer.

Strategic Separation

The holding company structure addresses regulatory and operational complexities arising from Paystack’s recent diversification. The company launched consumer payment app Zap and activated Paystack Microfinance Bank in 2025, entering sectors with distinct regulatory requirements from merchant processing.

By housing each business separately, Paystack maintains focus on its core payments operation while allowing newer ventures to develop independently. The structure also contains regulatory risk, preventing compliance issues in one unit from affecting others—critical given Nigeria’s separate licensing regimes for payments, banking, and consumer finance.

Since its 2015 founding, Paystack has grown from simplifying online payments for Nigerian merchants to operating across seven African countries, processing trillions of naira monthly. Profitability has enabled experimentation with new products, including TSG Labs’ exploration of emerging technologies.

“We are still firmly rooted in financial services, but we are open to solving problems that sit next to fintech or slightly beyond it, if they matter to African businesses,” Lobelle noted.

Banking Expansion

In January 2026, Paystack acquired and rebranded Ladder Microfinance Bank, securing a banking license to provide loans and digital banking services to small and medium enterprises. The acquisition addresses Nigeria’s estimated $32 billion SME financing gap.

“After working with thousands of businesses since 2016, we know payments are only one part of their challenges,” Akinlade said. “This setup lets us respond more directly, without losing focus on what we already do well.”

READ ALSO:

- Kano to Get ₦1 Trillion Metro Rail System as FG Approves Major Transport Project

- Angola Oil & Gas Launches in Luanda as $70B Investment Momentum Accelerates

- Nigeria Launches Locally-Made Armoured Combat Vehicle, Pledges Continued Support for Domestic Defence Manufacturing

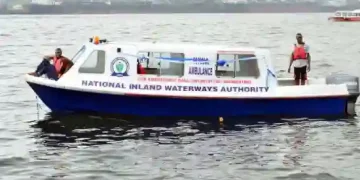

- NIWA Intensifies Campaign to Eliminate Boat Accidents Across Nigeria

- Activists Soweto and Frank Get N200,000 Bail Over Lagos Anti-Demolition Protest